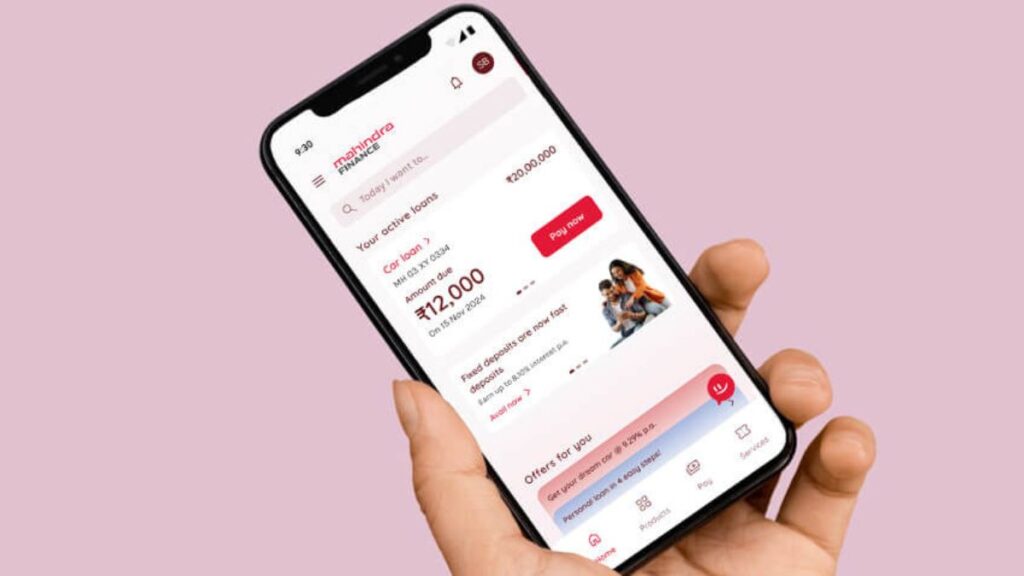

Managing finances on-the-go has never been easier, thanks to the MMFSL Web Mobile Menu. Whether you need to apply for loans, track your account details, or access customer support, this user-friendly app by Mahindra & Mahindra Financial Services Limited (MMFSL) is designed to simplify your financial journey.

Its intuitive design and robust functionality take the hassle out of financial management and put control at your fingertips. Let’s dive into the features, benefits, and tips to make the most of this powerful tool and explore why it’s becoming a must-have for modern financial planning.

Table of Contents

What is the MMFSL Web Mobile Menu?

The MMFSL Web Mobile Menu is a comprehensive financial application tailored to help users manage their accounts and perform essential transactions effortlessly. Designed with a streamlined interface, this app offers quick access to services such as loan applications, EMI calculations, branch locators, and more. It’s a one-stop solution for individuals looking to stay on top of their financial responsibilities while enjoying a smooth user experience.

Key Features Overview:

- Loan Applications: Apply for loans directly via the app, reducing paperwork and saving time.

- Account Management: Access account summaries, transaction history, and statements with a few clicks.

- Loan Calculators: Calculate EMIs and loan eligibility with ease, helping you plan better.

- Branch Locator: Find nearby MMFSL branches and ATMs, complete with directions.

- Customer Support: Access FAQs, feedback forms, and contact options for any assistance you need.

- Special Offers: Discover exclusive discounts and deals tailored for your financial needs.

Why Choose MMFSL Web Mobile Menu?

Here’s why the MMFSL Web Mobile Menu stands out:

- Convenience: Manage your finances anytime, anywhere, eliminating the need for physical visits to branches.

- User-Friendly Interface: Simplified navigation for users of all tech skill levels, ensuring accessibility for everyone.

- Security: Robust measures, including encryption and multi-factor authentication, safeguard your financial data.

- Real-Time Updates: Stay informed with instant transaction alerts and account summaries that update seamlessly.

- Comprehensive Features: From loan tracking to special offers, the app covers all aspects of financial management.

- Personalization: Tailored content and recommendations based on your financial history and preferences.

By combining cutting-edge technology with user-centric design, MMFSL Web Mobile Menu delivers an unparalleled banking experience that adapts to your lifestyle.

How to Get Started

Getting started with the MMFSL Web Mobile Menu is a straightforward process. Follow these steps to unlock the potential of seamless financial management:

Downloading the App:

- Visit the Google Play Store or Apple App Store.

- Search for “MMFSL Web Mobile Menu” and click “Install.”

- Ensure the app is updated to the latest version for optimal performance.

Registering on the App:

- Open the app and click on “Register.”

- Provide your mobile number, Aadhaar details, and date of birth.

- Create a secure 4-digit app password to ensure your account’s safety.

- Verify your mobile number via OTP and complete the registration process.

Pro Tip: Bookmark your most-used features for even faster access and enable biometric login for added convenience.

Navigating the MMFSL Web Mobile Menu

Home Screen Overview:

- Account Summary: View balances, transaction history, and upcoming payments, all displayed clearly on the home screen.

- Quick Links: Access loan applications, payment options, and support services instantly.

- Menu Bar: Navigate sections like Services, Branch Locator, and Contact Us effortlessly.

- Interactive Dashboard: Get a real-time overview of your financial health and performance metrics.

Example Menu Structure:

| Feature | Description |

| Loan Applications | Apply for personal and business loans directly. |

| Account Details | Check balances, download statements, and track payments. |

| Branch Locator | Find branches and ATMs nearby with accurate directions. |

| Offers & Discounts | Access personalized financial offers tailored for you. |

| Feedback | Share your experience and suggestions to improve services. |

Features in Focus

Loan Applications:

Applying for a loan has never been simpler:

- Open the app and navigate to the “Loan Applications” section.

- Fill in required details such as income, loan amount, and preferred tenure.

- Upload necessary documents, including ID and address proof.

- Track the status of your application in real-time and receive updates instantly.

- Receive personalized loan offers based on your credit history and profile.

Loan Calculators:

Estimate your finances with ease:

- EMI Calculator: Enter loan amount, tenure, and interest rate to calculate monthly payments accurately.

- Eligibility Calculator: Determine the loan amount you qualify for based on your income and existing obligations.

- Repayment Schedule Generator: Visualize payment breakdowns over the loan tenure, including principal and interest components.

| Calculator Type | Features |

| EMI Calculator | Calculates monthly installments based on provided parameters. |

| Eligibility Calculator | Determines loan eligibility, factoring in income and credit score. |

| Repayment Schedule | Provides a detailed repayment timeline, breaking down principal and interest. |

Account Management:

Keep track of your financial health effectively:

- View account summaries to stay updated on balances and liabilities.

- Monitor transaction history, ensuring transparency in every transaction.

- Download detailed statements for offline use or tax purposes.

- Set budgeting goals and track expenses directly within the app.

Practical Tips for Users

- Set Alerts: Enable notifications to stay updated on due dates, payment confirmations, and special offers.

- Secure Your Account: Regularly update your password and enable two-factor authentication for enhanced security.

- Use the Branch Locator: Plan visits efficiently by using the built-in locator to find the nearest branch or ATM with step-by-step directions.

- Explore Offers: Regularly check the Offers & Discounts section for personalized deals and savings opportunities.

- Optimize Usage: Familiarize yourself with all app features through the Help section and interactive tutorials.

Customer Support Made Easy

The MMFSL Web Mobile Menu prioritizes accessibility. You can reach customer care through:

- Feedback Form: Share your queries directly via the app and receive prompt responses.

- Contact Options: Choose between phone, email, or live chat for real-time assistance.

- FAQs: Access answers to common questions instantly, saving time and effort.

- Guided Assistance: Use the in-app step-by-step guides for resolving common issues quickly.

Pro Tip: Keep your app updated to enjoy the latest features, bug fixes, and support tools. Use the “Help” section to find guides and tutorials tailored to new users.

Conclusion: Transform Your Financial Management

The MMFSL Web Mobile Menu is more than just an app; it’s a financial assistant in your pocket. With features designed for convenience, security, and efficiency, it empowers users to take control of their finances effortlessly. Whether you’re applying for a loan, checking account balances, or exploring personalized offers, this app has you covered. Its blend of technology and practicality ensures that financial management is no longer a chore but a seamless part of your daily routine.

Ready to experience hassle-free financial management?

Download the MMFSL Web Mobile Menu today and take the first step toward smarter financial planning. Don’t wait—make your financial journey smoother, more efficient, and more rewarding with MMFSL’s cutting-edge app!